PA Fannie Mae/Freddie Mac 3039 2016-2026 free printable template

Show details

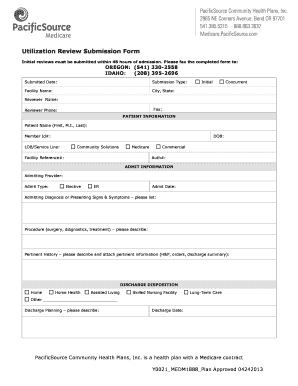

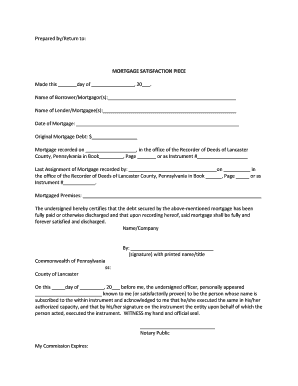

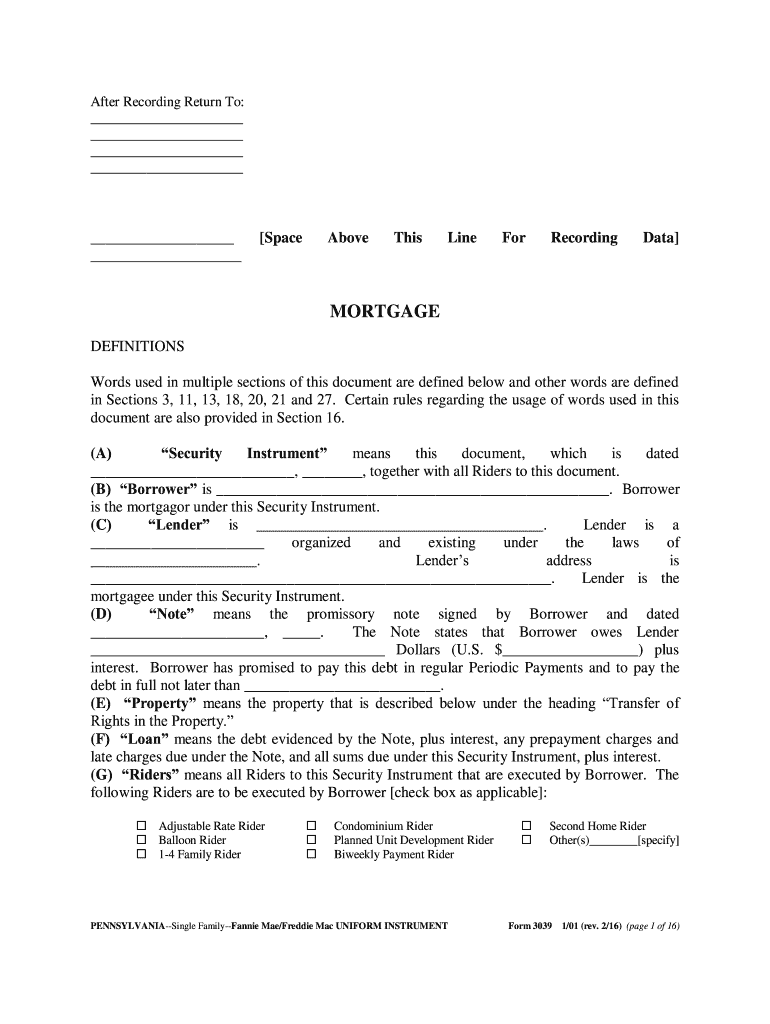

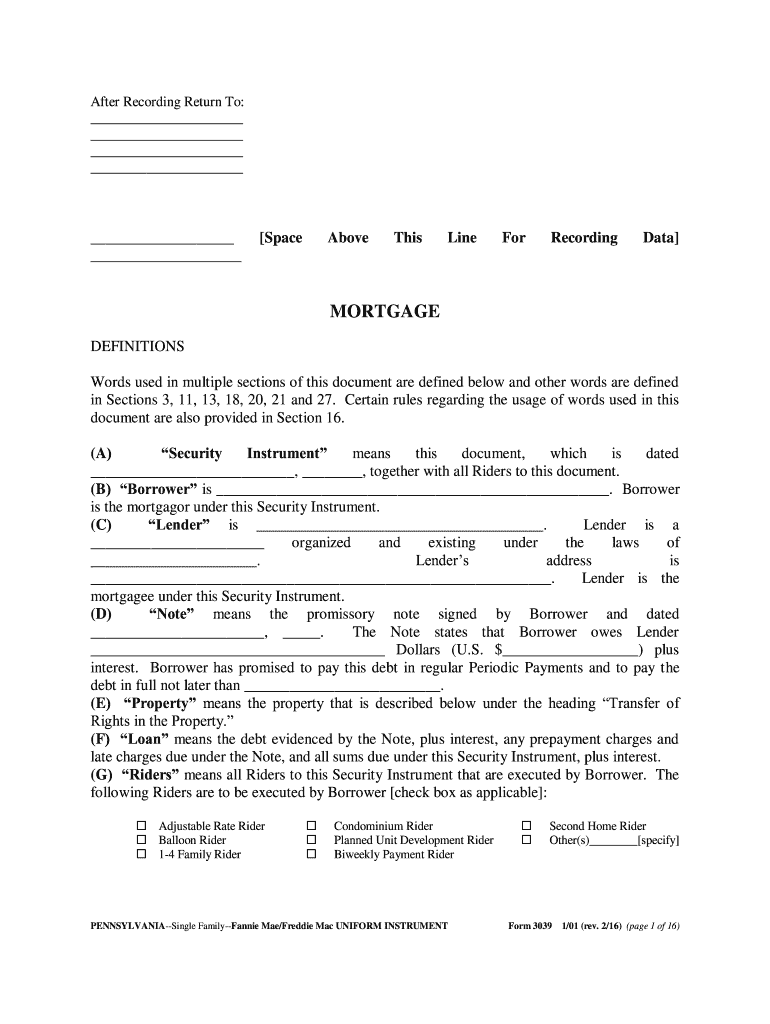

This document is a mortgage agreement that defines terms and conditions related to the loan secured by property, including borrower and lender obligations, payment terms, and remedies in case of default.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa mortgage fillable form

Edit your show details affiliated with any government organization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 3039 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit begin by downloading the pa fannie mae freddie mac financed such as address and type of property online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fannie mae site pdffiller com site blog pdffiller com form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Fannie Mae/Freddie Mac 3039 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fannie mae mortgage requirements form

How to fill out PA Fannie Mae/Freddie Mac 3039

01

Begin by downloading the PA Fannie Mae/Freddie Mac 3039 form from the official website.

02

Enter the borrower's information including name, address, and contact number in the designated fields.

03

Provide the information regarding the property being financed such as address and type of property.

04

Fill out the loan details including the loan amount, interest rate, and loan term.

05

Complete the sections related to employment and income information of the borrower.

06

If applicable, include co-borrower's information as well.

07

Review the form for any errors or missing information.

08

Sign and date the form at the bottom as required.

09

Submit the completed form to the appropriate lender or mortgage broker.

Who needs PA Fannie Mae/Freddie Mac 3039?

01

Individuals applying for a mortgage through Fannie Mae or Freddie Mac programs in Pennsylvania.

02

Homebuyers seeking to finance the purchase of a home with a conventional loan.

03

Mortgage lenders and brokers who require the documentation for processing loan applications.

Fill

freddie mac

: Try Risk Free

People Also Ask about

What is an example of a balloon payment?

Example of a Balloon Loan Let's say a person takes out a $200,000 mortgage with a seven-year term and a 4.5% interest rate. Their monthly payment for seven years is $1,013. At the end of the seven-year term, they owe a $175,066 balloon payment.

What is a balloon payment rider?

IF NOT PAID EARLIER, THIS LOAN IS PAYABLE IN FULL ON (THE “MATURITY DATE”). BORROWER MUST REPAY THE ENTIRE UNPAID PRINCIPAL BALANCE OF THE LOAN AND INTEREST THEN DUE. THIS IS CALLED A “BALLOON PAYMENT”. THE LENDER IS UNDER NO OBLIGATION TO REFINANCE THE LOAN AT THAT TIME.

What is an example of a security instrument?

This collateral can take many different forms, but the most common type is real estate. Other security instruments include things like vehicles, jewelry, art, and even patents or copyrights. Basically, anything of value that can be used as collateral can be considered a security instrument.

What are the examples of mortgage security instruments?

Security instruments for regularly amortizing mortgages include the Fannie Mae/Freddie Mac Uniform Mortgages, Mortgage Deeds, Deeds of Trust, or Security Deeds for each of the jurisdictions from which we purchase conventional mortgages.

What is the master form of a mortgage?

Master Form Security Instrument – The Master Form Security Instrument is the Master Form Mortgage or Deed of Trust that is permitted under certain State statutes to be recorded by originating lenders in a given recording jurisdiction in the State.

What is the Fannie Mae balloon payment rider?

Fannie Mae has developed a Balloon Mortgage Program which provides that the borrower may exercise an option of (1) a new note and a new mortgage at a fixed rate of interest or (2) a new note and modification of the existing mortgage at a fixed rate of interest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find PA Fannie MaeFreddie Mac 3039?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific PA Fannie MaeFreddie Mac 3039 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit PA Fannie MaeFreddie Mac 3039 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing PA Fannie MaeFreddie Mac 3039, you need to install and log in to the app.

Can I edit PA Fannie MaeFreddie Mac 3039 on an iOS device?

Create, modify, and share PA Fannie MaeFreddie Mac 3039 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is PA Fannie Mae/Freddie Mac 3039?

PA Fannie Mae/Freddie Mac 3039 is a specific form used in Pennsylvania for reporting and reconciling certain information related to mortgage loans that are backed by Fannie Mae or Freddie Mac.

Who is required to file PA Fannie Mae/Freddie Mac 3039?

Entities that originate, service, or hold mortgages under Fannie Mae or Freddie Mac guidelines are required to file PA Fannie Mae/Freddie Mac 3039.

How to fill out PA Fannie Mae/Freddie Mac 3039?

To fill out PA Fannie Mae/Freddie Mac 3039, you need to gather all relevant information regarding the loans, including borrower details, loan amounts, and payment schedules, and enter them into the designated sections of the form following the provided instructions.

What is the purpose of PA Fannie Mae/Freddie Mac 3039?

The purpose of PA Fannie Mae/Freddie Mac 3039 is to provide the state with accurate information regarding mortgage loans, ensuring compliance with state regulations and facilitating the tracking of mortgage-backed securities.

What information must be reported on PA Fannie Mae/Freddie Mac 3039?

The information that must be reported on PA Fannie Mae/Freddie Mac 3039 includes loan identification numbers, originated amounts, interest rates, borrower names, and relevant transaction dates.

Fill out your PA Fannie MaeFreddie Mac 3039 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA Fannie MaeFreddie Mac 3039 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.