PA Fannie Mae/Freddie Mac 3039 2016-2024 free printable template

Show details

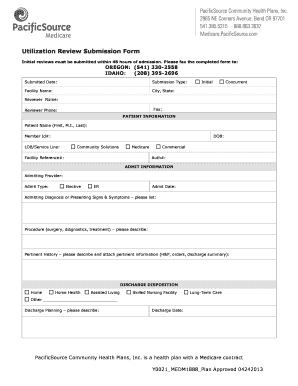

After Recording Return To: SpaceAboveThisLineForRecordingData MORTGAGE DEFINITIONS Words used in multiple sections of this document are defined below and other words are defined in Sections 3, 11,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your pennsylvania mortgage form 2016-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pennsylvania mortgage form 2016-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pennsylvania mortgage form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pa form 3039. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

PA Fannie Mae/Freddie Mac 3039 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pennsylvania mortgage form 2016-2024

How to fill out Pennsylvania mortgage form?

01

Gather all necessary documents: Before starting to fill out the Pennsylvania mortgage form, make sure you have all the required documents in hand. These may include identification, proof of income, bank statements, tax returns, and other relevant financial information.

02

Read the instructions: Carefully read the instructions provided with the Pennsylvania mortgage form. Understanding the requirements and guidelines will help you accurately complete the form.

03

Provide personal information: Begin by filling in your personal information, such as your name, address, contact details, and social security number. Ensure that all the information provided is correct and up-to-date.

04

Provide financial information: Proceed to enter your financial information, including details about your employment, income, and assets. Be prepared to provide supporting documentation, such as pay stubs and bank statements, to substantiate the information provided.

05

Fill in loan details: Complete the sections related to the loan details, such as the loan amount, purpose of the loan, desired interest rate, and repayment terms. If you have chosen a specific mortgage program, indicate it accordingly.

06

Disclose liabilities and debts: Provide an accurate account of your outstanding debts and liabilities, including credit card balances, student loans, auto loans, and other financial obligations. This information helps lenders assess your financial health and loan eligibility.

07

Review and sign the form: Carefully review the completed Pennsylvania mortgage form for any errors or omissions. Ensure that all necessary sections have been filled out accurately. After thoroughly reviewing the form, sign and date it in the designated spaces.

Who needs Pennsylvania mortgage form?

01

Homebuyers: Individuals who are planning to purchase a home in Pennsylvania and require a mortgage loan will need to fill out the Pennsylvania mortgage form. This form is an essential part of the mortgage application process.

02

Refinancers: Borrowers who already own a property in Pennsylvania and are seeking to refinance their existing mortgage will also need to complete the Pennsylvania mortgage form. This form helps lenders evaluate the borrower's financial situation and determine their eligibility for refinancing.

03

Lenders: Mortgage lenders and financial institutions that offer mortgage loans in Pennsylvania may require prospective borrowers to fill out the Pennsylvania mortgage form. This form assists lenders in evaluating the borrower's creditworthiness and making informed lending decisions.

Fill mortgage 3039 fillable : Try Risk Free

People Also Ask about pennsylvania mortgage form

What is an example of a balloon payment?

What is a balloon payment rider?

What is an example of a security instrument?

What are the examples of mortgage security instruments?

What is the master form of a mortgage?

What is the Fannie Mae balloon payment rider?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file pennsylvania mortgage form?

The lender or servicer of the mortgage loan is required to file the Pennsylvania Mortgage Form.

What is the penalty for the late filing of pennsylvania mortgage form?

The penalty for the late filing of a Pennsylvania mortgage form is a fine of up to $1,000 and/or a potential imprisonment of up to one year.

What is pennsylvania mortgage form?

The Pennsylvania mortgage form is a legal document that outlines the terms and conditions of a mortgage loan agreement between a lender (typically a bank or financial institution) and a borrower (homebuyer or homeowner). This form includes important information such as the loan amount, interest rate, repayment schedule, loan term, and any additional fees or costs associated with the mortgage. It is a legally binding agreement that both parties must sign to finalize the mortgage transaction.

How to fill out pennsylvania mortgage form?

To fill out a mortgage form in Pennsylvania, follow these steps:

1. Obtain the correct form: Visit the Pennsylvania Department of Banking and Securities website or contact a local mortgage lender to obtain the specific form required for your mortgage application.

2. Gather required information: Collect all the necessary information and documentation to fill out the form. This typically includes your personal details, employment history, income information, and financial statements.

3. Read the instructions carefully: Before completing the form, read the instructions provided. This will help you understand the requirements and any specific guidelines for filling out the form.

4. Provide personal information: Fill in your personal details accurately, including your full name, social security number, address, and contact information.

5. Disclose employment information: Provide your current and previous employment information, including the name of your employer, job title, duration of employment, and income details.

6. Document your income: Fill out the income section with accurate details about your earnings, including salary, bonuses, commissions, or any other sources of income. Attach supporting documents like pay stubs, tax returns, or bank statements as required.

7. Detail your assets and liabilities: Provide a comprehensive list of your assets, such as bank accounts, investments, and real estate holdings. Additionally, disclose all your liabilities, including outstanding loans, credit card debts, and any other financial obligations.

8. Explain the purpose of the loan: Specify the purpose of the mortgage loan, whether it's for purchasing a home, refinancing an existing loan, or other approved reasons.

9. Complete the property details: Fill in the details about the property you intend to purchase or refinance, including the address, purchase price, and estimated property value.

10. Sign and date the form: Once you have completed filling out the form, carefully review it for accuracy and then sign and date it as required. Ensure all supporting documents are attached.

11. Submit the form: Submit the completed form, along with any supporting documentation, to the appropriate authority or mortgage lender, following their specific submission instructions.

Note: It is recommended to consult with a mortgage specialist or seek legal advice to ensure accurate completion of the mortgage form.

What is the purpose of pennsylvania mortgage form?

The purpose of a Pennsylvania mortgage form is to document the details and terms of a mortgage agreement between a lender and a borrower in the state of Pennsylvania. This form is used to legally record the mortgage on the property, including information about the property, parties involved, loan amount, interest rate, repayment terms, and any other relevant details. It serves as a binding agreement that protects the rights and obligations of both the lender and borrower throughout the duration of the mortgage.

What information must be reported on pennsylvania mortgage form?

To accurately complete a Pennsylvania mortgage form, the following information generally needs to be reported:

1. Borrower Information: Full legal name(s) of the borrower(s), social security number(s), date(s) of birth, current residential address(es), phone number(s), and email address(es).

2. Property Information: Complete address of the property being mortgaged, including street name, city, state, and zip code.

3. Loan Details: Loan amount requested, loan term, interest rate, loan purpose (e.g., purchase, refinance), estimated closing date, and details of any existing liens on the property.

4. Income and Employment: Employment information for each borrower, such as current employer name, address, phone number, job title, and duration of employment. Additionally, income details such as base salary, bonuses, commissions, and any other sources of income may be required.

5. Asset Information: Reports on the borrower's assets such as bank accounts, investment accounts, retirement accounts, and others may be necessary. This typically includes the institution name, account number, and current balance.

6. Liabilities and Debts: Borrowers need to disclose any outstanding debts, liabilities, or obligations, including credit cards, student loans, car loans, and other mortgages. The reporting should include the creditor's name, account number, current balance, and monthly payment details.

7. Personal Financial Statement: Some mortgage forms may require the completion of a personal financial statement, providing a comprehensive overview of the borrower's assets, liabilities, and net worth.

8. Consent and Authorization: Borrowers may need to provide consent and authorization for the lender to obtain credit reports, verify employment, obtain tax transcripts, and perform other standard background checks necessary for the loan approval process.

It is important to note that the exact details and requirements may vary based on the specific form or lender, so it is essential to carefully read and follow the instructions provided with the mortgage form.

Where do I find pennsylvania mortgage form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific pa form 3039 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit liens lien straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing lien secured, you need to install and log in to the app.

Can I edit property lien on an iOS device?

Create, modify, and share agreement mortgage form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your pennsylvania mortgage form 2016-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Liens Lien is not the form you're looking for?Search for another form here.

Keywords relevant to agreement property mortgage form

Related to property lien owner

If you believe that this page should be taken down, please follow our DMCA take down process

here

.